About Banknaked

Ever feel like your bank is quietly pickpocketing you every month? You're not paranoid. Banks are masters of the fine-print fee, the hidden markup, the mysterious "service charge." Banknaked is your financial truth-teller, your banking bouncer that kicks out all the BS. We show you the raw, unfiltered cost of your banking in plain language. Connect your account via secure, read-only Open Banking, and in minutes, we'll autopsy your statements. We expose every sneaky monthly charge, foreign exchange rip-off, and ATM fee, giving you a clean breakdown and an annual projection of the damage. But we don't just point out the problem—we hand you the solution. Get personalized recommendations for cheaper account options that actually fit your life, so you can switch, negotiate, or finally cancel those useless premium features. We're privacy-first: no moving your money, no selling your data, just encrypted processing and the power to delete everything whenever you want. It's your money. Stop letting them hide where it really goes. Get naked with your finances.

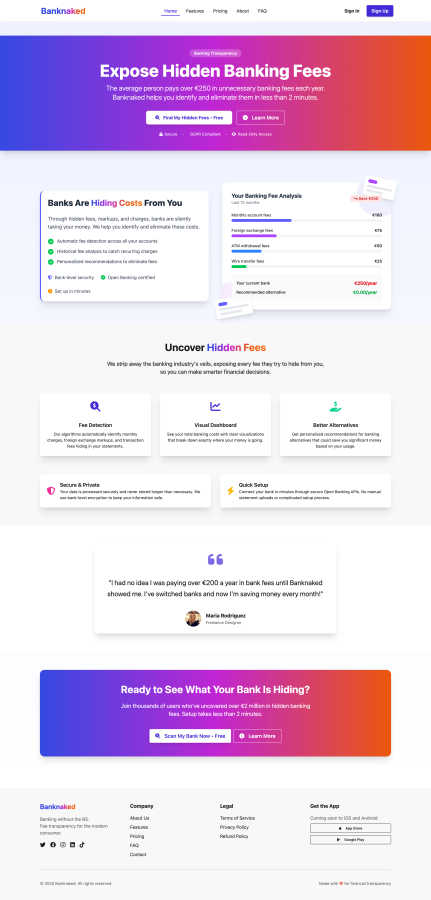

Features of Banknaked

Fee Detection Autopsy

Our algorithm is a bloodhound for hidden costs. It doesn't just skim your statement; it performs a full forensic audit, automatically sniffing out monthly maintenance charges, foreign exchange markups, transaction fees, and those vague "miscellaneous" costs banks love to bury. We translate bank-speak into plain English, so you finally understand every single euro leaving your account.

Visual Dashboard of Financial Truth

Forget dense, confusing statements. Your financial reality is displayed on a crystal-clear, visual dashboard. See your total banking costs sliced and diced with intuitive charts and graphs. Watch your "last 12 months" tabulate in real-time, breaking down exactly where your money is vanishing—from wire transfers to ATM withdrawals—so the big picture hits you right between the eyes.

Smarter Bank Matchmaker

Why guess if there's a better bank for you? We analyze your actual spending and transaction habits to play financial cupid. We then serve up personalized, data-driven recommendations for alternative accounts or services that could save you serious cash. See the exact annual price difference between your current money-drain and a leaner, meaner alternative.

Fort Knox-Level Security & Privacy

We get naked with fees, not with your data. Our connection is read-only via certified Open Banking APIs—we can't touch your money, period. Your data is protected with bank-level encryption, processed securely, and never stored longer than needed. We're GDPR-compliant and give you full control to delete your data with one click. Total transparency, total control.

Use Cases of Banknaked

The Fee-Fatigue Fighter

You're sick of seeing random charges but can't face the hours of statement-sleuthing needed to find them. Connect Banknaked and in under two minutes, get a definitive list of every fee you're paying. We hand you the evidence you need to call your bank and demand refunds or downgrades, turning frustration into actionable power and instant savings.

The Proactive Budget Ninja

You're on top of your subscriptions and coffee spend, but banking fees are a blind spot. Use Banknaked to integrate these sneaky costs into your true monthly financial picture. Our annual projection shows you the shocking yearly total, motivating you to plug this leak and reallocate hundreds of euros back into your savings or investment goals.

The Digital Nomad & Traveler

If you're frequently hit with foreign transaction fees and costly ATM withdrawals abroad, you're bleeding money. Banknaked isolates and quantifies these markups specifically. We then recommend fee-free travel cards or bank accounts tailored to international use, ensuring your next adventure isn't funded by bank profit margins.

The Financial Spring-Cleaner

It's time for a financial health check, and your banking relationship is overdue for review. Banknaked provides the hard data to make an informed switch. Compare your current bank's total cost against our curated alternatives. Ditch the dead weight, negotiate from a position of strength, or finally open that modern account you've been eyeing, all with confidence.

Frequently Asked Questions

Is Banknaked safe to connect to my bank?

Absolutely. We use secure, regulated Open Banking connections that are read-only. This means we can only see your transaction data—we cannot move money, make payments, or change anything in your account. It's like giving someone a view-only link to a spreadsheet. Your data is encrypted, and we are fully GDPR compliant. You are always in control and can delete your data instantly.

What banks do you support?

We connect to a wide range of major banks and financial institutions across Europe via secure Open Banking APIs. The connection process during sign-up will show you a list of supported banks in your country. The setup is instant and automated—no need for manual statement uploads.

How do you find fees my bank doesn't clearly show?

Banks often use generic descriptions or category codes. Our algorithms are trained to recognize these patterns and identify transactions that are bank fees, not regular purchases. We cross-reference amounts, payees, and frequencies to label things like "account maintenance," "FX margin," and "out-of-network ATM" fees, presenting them in clear, honest language.

What happens after I see my fees? Do you help me switch?

We empower you with knowledge and options. First, we show you your total cost breakdown. Then, based on your actual account activity, we provide personalized recommendations for alternative banking products that could save you money. We give you the facts and comparisons; the decision to switch, negotiate with your current bank, or simply cancel add-ons is yours.

You may also like:

Fieldtics

Fieldtics is an all-in-one platform for service businesses, streamlining scheduling, customer management, invoicing, and getting paid.

Moon Banking

The largest global bank dataset with AI-native integrations (MCP, OpenClaw, API). For analysts, marketers, developers, institutions.

Tailride

AI-powered invoice and receipt automation from email and web portals