Pure Tax Investigations

Pure Tax Investigations fights fiercely for businesses facing complex HMRC tax disputes, delivering tailored and expe...

Visit

Welcome to the battleground of tax disputes, where Pure Tax Investigations stands as your fearless champion. We are the ultimate specialists in navigating the treacherous waters of tax investigations and disputes, serving as a robust buffer between our clients and HMRC. Our mission? To fight tooth and nail for the entrepreneurs and businesses facing the relentless scrutiny of tax investigations, whether it's a routine compliance check or the invasive Code of Practice 9 (COP9) and Code of Practice 8 (COP8). Our approach is cool, calm, and collected, delivering bespoke, pragmatic solutions tailored to your unique circumstances. With over 20 years of experience led by Amit Puri, an ex-HMRC senior Tax Inspector, our team is equipped with the knowledge and expertise to secure the best outcomes for our clients. We specialize in tax disclosures, including the Worldwide Disclosure Facility (WDF) and Let Property Campaign (LPC), ensuring that your path to resolution is clear and confident. At Pure Tax Investigations, we don’t just preserve wealth; we empower our clients to thrive amidst the complexities of tax affairs.

You may also like:

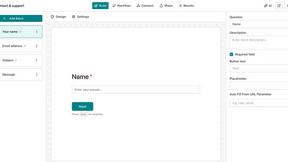

AntForms

AntForms lets you create unlimited forms with free analytics and integrations, all without credit card hassles.

Fieldtics

Fieldtics is your all-in-one powerhouse for scheduling, managing customers, invoicing, and getting paid effortlessly.

Moon Banking

Unlock the world of banking with Moon Banking, your gateway to AI-driven insights on 24,167 banks across 205 countries.