Addy AI

About Addy AI

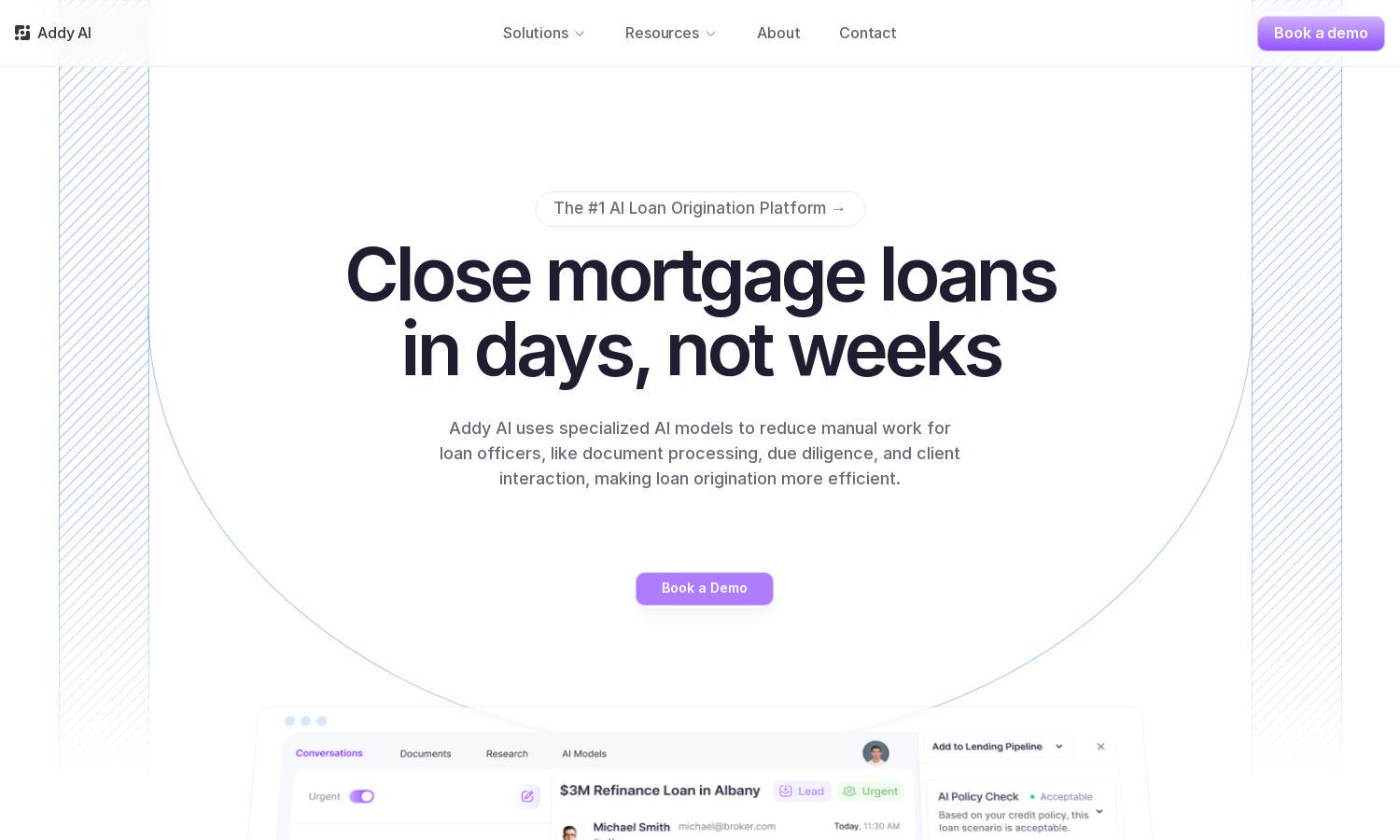

Addy AI revolutionizes the mortgage lending process for loan officers with powerful AI automation tools. It swiftly processes documents, optimizes client follow-ups, and ensures data compliance, allowing lenders to close loans faster, improve client satisfaction, and enhance operational efficiency. Experience the future of lending with Addy AI.

Addy AI offers flexible pricing plans tailored for mortgage lenders, with tiers that provide varying levels of AI capabilities and support. Special discounts for long-term subscriptions promote cost-effectiveness. Upgrading enhances features, streamlines processes, and maximizes efficiency, making Addy AI an invaluable investment in the lending landscape.

Addy AI features a user-friendly interface, designed for easy navigation and seamless interaction. The platform integrates various tools and systems for a cohesive experience, enabling users to access mortgage processing features effortlessly. With its intuitive design, Addy AI ensures that lenders can quickly adopt and benefit from its innovative solutions.

How Addy AI works

Users begin their journey with Addy AI by signing up for a demo, allowing them to understand its capabilities. The onboarding process is straightforward, guiding users through training custom AI models to automate key tasks. Once set up, users can easily navigate the interface, integrate their existing systems, and effectively utilize Addy AI's features, resulting in significant time savings and enhanced efficiency in loan origination.

Key Features for Addy AI

AI-Powered Document Processing

Addy AI's AI-powered document processing feature revolutionizes the way mortgage lenders manage paperwork. By utilizing advanced computer vision technology, it swiftly extracts relevant data from large documents, dramatically reducing manual effort. This unique capability empowers loan officers to focus on client interactions and close loans faster, enhancing overall productivity.

Instant Loan Evaluations

Addy AI offers instant loan evaluations, providing immediate assessments based on users' credit policies. This feature allows lenders to identify ineligibility quickly and offers actionable suggestions to improve borrowers' chances, making the lending process more efficient. Trust Addy AI to streamline your eligibility checks for faster decision-making.

Custom AI Model Training

With Addy AI, lenders can train custom AI models tailored to their specific needs, adding a unique layer of personalization to their operations. This feature allows organizations to fine-tune their AI to manage client interactions and follow-ups effectively, optimizing workflow and improving client satisfaction.

You may also like: