Player2.tax

About Player2.tax

Player2.tax serves as your dedicated AI Tax research assistant, specifically designed for individuals and businesses navigating the complexities of Australian taxation. Its innovative chatbot function delivers precise answers and guidance, optimizing your tax research and saving you countless hours in the process.

Player2.tax offers flexible subscription plans tailored to your needs, ensuring affordable access to expert tax assistance. Users can choose from multiple tiers, each providing value-added services like personalized support and enhanced features. Upgrading unlocks more resources for efficient tax management.

Player2.tax features an intuitive user interface that promotes smooth navigation throughout its platform. With a well-organized layout and user-friendly design, accessing its chatbot services and tax information is seamless, creating an engaging experience for users seeking efficient taxation solutions.

How Player2.tax works

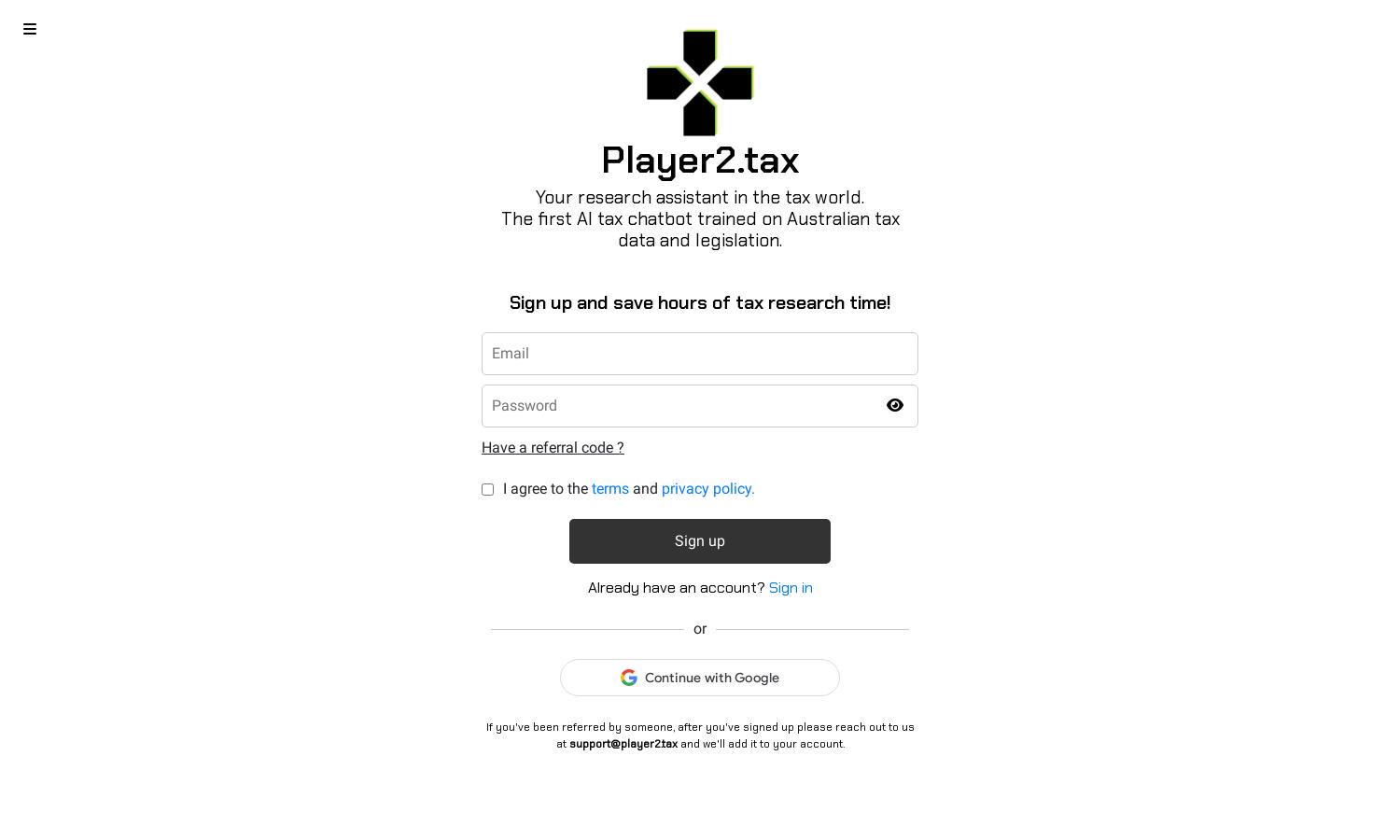

To utilize Player2.tax, users start by signing up and creating an account. Once onboarded, they can log in and access the AI-powered tax chatbot. The chatbot engages users by answering queries based on Australian taxation data, enabling quick navigation through relevant laws and regulations with exceptional ease.

Key Features for Player2.tax

AI Tax Chatbot

The standout feature of Player2.tax is its AI Tax Chatbot, which provides users with immediate access to expert knowledge on Australian taxation. This innovative tool answers complex queries and simplifies the research process, saving users time and reducing the stress associated with tax compliance.

Personalized Assistance

Player2.tax offers personalized assistance tailored to individual user needs. By leveraging AI, the platform engages seamlessly with users to provide specific advice and solutions, enhancing the overall experience and ensuring that users receive guidance that is both relevant and actionable.

Time-Saving Features

Another key feature of Player2.tax is its time-saving capabilities. The platform streamlines your tax research process, enabling users to access vital information quickly. This efficiency significantly reduces the hours spent on taxation matters, allowing users to focus on other important areas of their finances.