Jinnee

About Jinnee

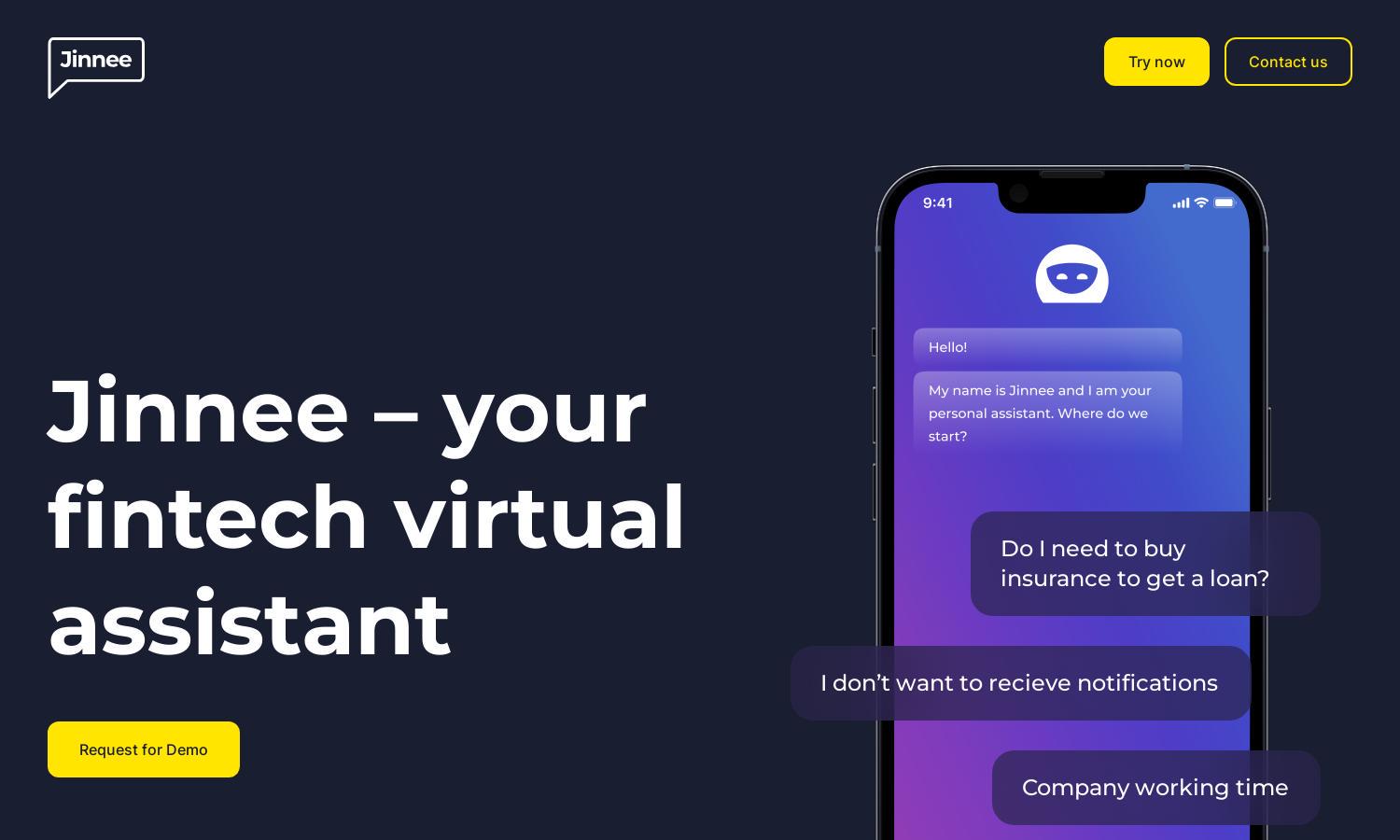

Jinnee is a virtual assistant tailored for fintech companies, designed to enhance customer support through advanced AI automation. By analyzing inquiries and learning from interactions, Jinnee offers personalized financial advice, delivering instant responses to client needs. This innovative solution aids businesses in managing growing customer requests efficiently.

Jinnee offers competitive pricing plans to suit various business needs. Each tier provides access to unique features, including advanced analytics and personalized support. By upgrading, users can unlock enhanced capabilities to improve customer satisfaction and retention, ensuring greater value for their business and clients.

Jinnee features a user-friendly interface that maximizes ease of navigation and accessibility. Its clear layout allows users to effortlessly interact with the chatbot for instant support. With intuitive design elements, Jinnee ensures an enjoyable experience while effectively addressing customer inquiries and needs.

How Jinnee works

Users begin by onboarding with Jinnee, setting up their preferences and defining their specific banking needs. The intuitive interface guides users to navigate features seamlessly, where they can interact with the chatbot to receive real-time assistance. Jinnee utilizes AI to learn from interactions, providing tailored responses, solving queries, and delivering analytics that drive user satisfaction in the financial sector.

Key Features for Jinnee

24/7 Customer Support

Jinnee provides round-the-clock customer support, allowing users to receive immediate assistance anytime. This unique feature ensures clients can resolve issues without delay, significantly enhancing customer experience and satisfaction.

Personalized Banking Services

With Jinnee acting as a virtual financial advisor, clients receive personalized advice on financial matters instantly. This feature helps users quickly get tailored solutions, enhancing banking experiences and fostering better relationships with financial institutions.

Automated Learning

Jinnee incorporates automated learning capabilities that enable it to understand client intents over time. By continuously adapting to user preferences, this feature ensures increasingly relevant and effective interactions, enhancing customer satisfaction and loyalty.

You may also like: