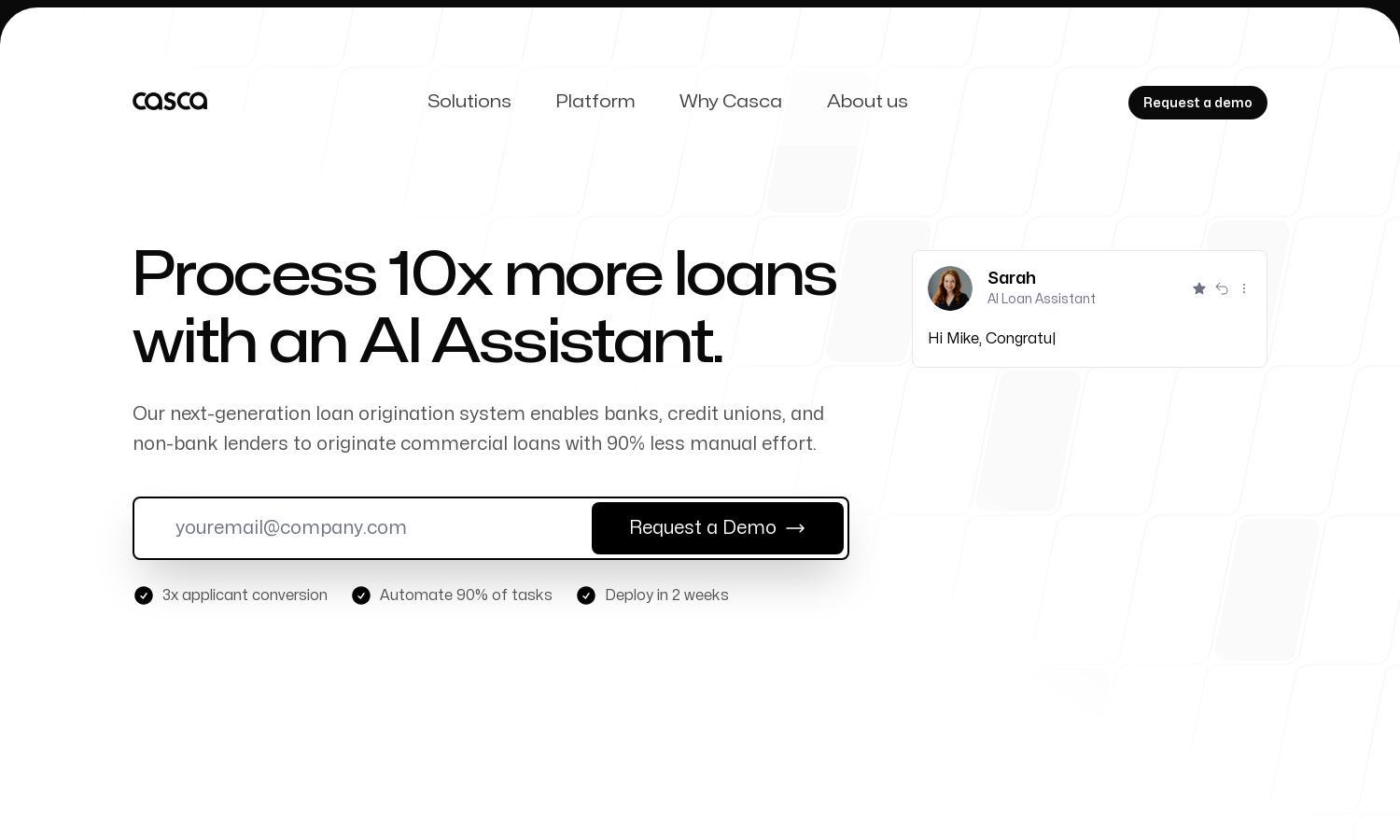

Casca

About Casca

Casca is a groundbreaking platform that modernizes loan origination for banks and lenders. By leveraging AI to streamline processes like KYB checks and document collection, it drastically reduces manual effort, boosts lead conversion rates, and enhances user experience, making banking magical for small businesses.

Casca offers tailored pricing plans to accommodate various financial institutions, ensuring competitiveness and value. Each plan provides unique features that enhance loan processing efficiency, with potential discounts for bulk usage. Upgrading unlocks greater functionality and further streamlines the user’s loan origination workflow.

Casca's user interface is designed for simplicity and efficiency, making navigation intuitive for all users. The clean layout allows users to easily access essential features, and the platform’s unique tools enhance the overall browsing experience, ensuring a seamless transition throughout the loan origination process.

How Casca works

Users start by signing up on Casca and receive guidance through onboarding, which simplifies initial setup. Once on board, they can access the AI loan assistant for inquiries and application support, utilize automated KYB checks, track loan progress via the portal, and benefit from document analysis, all designed to streamline and enhance the loan origination experience.

Key Features for Casca

AI Loan Assistant

The AI Loan Assistant offered by Casca sets a new standard in loan origination. It provides 24/7 support, answering inquiries instantly and handling document collection with minimal manual input. This unique feature allows banks to significantly improve operational efficiency and enhance borrower engagement.

Automated KYB Checks

Casca's automated KYB checks revolutionize the verification process by instantly analyzing over 40 checks. This feature accelerates the loan cycle time and reduces manual efforts, making it a crucial element for banks eager to streamline their operations and increase efficiency in lending.

Digital Loan Application

Casca's digital loan application process achieves a conversion rate three times higher than traditional methods. This cutting-edge feature provides a user-friendly experience for applicants, enabling them to complete applications swiftly and increasing the overall efficiency of the lending process for financial institutions.

You may also like: