Zeni

About Zeni

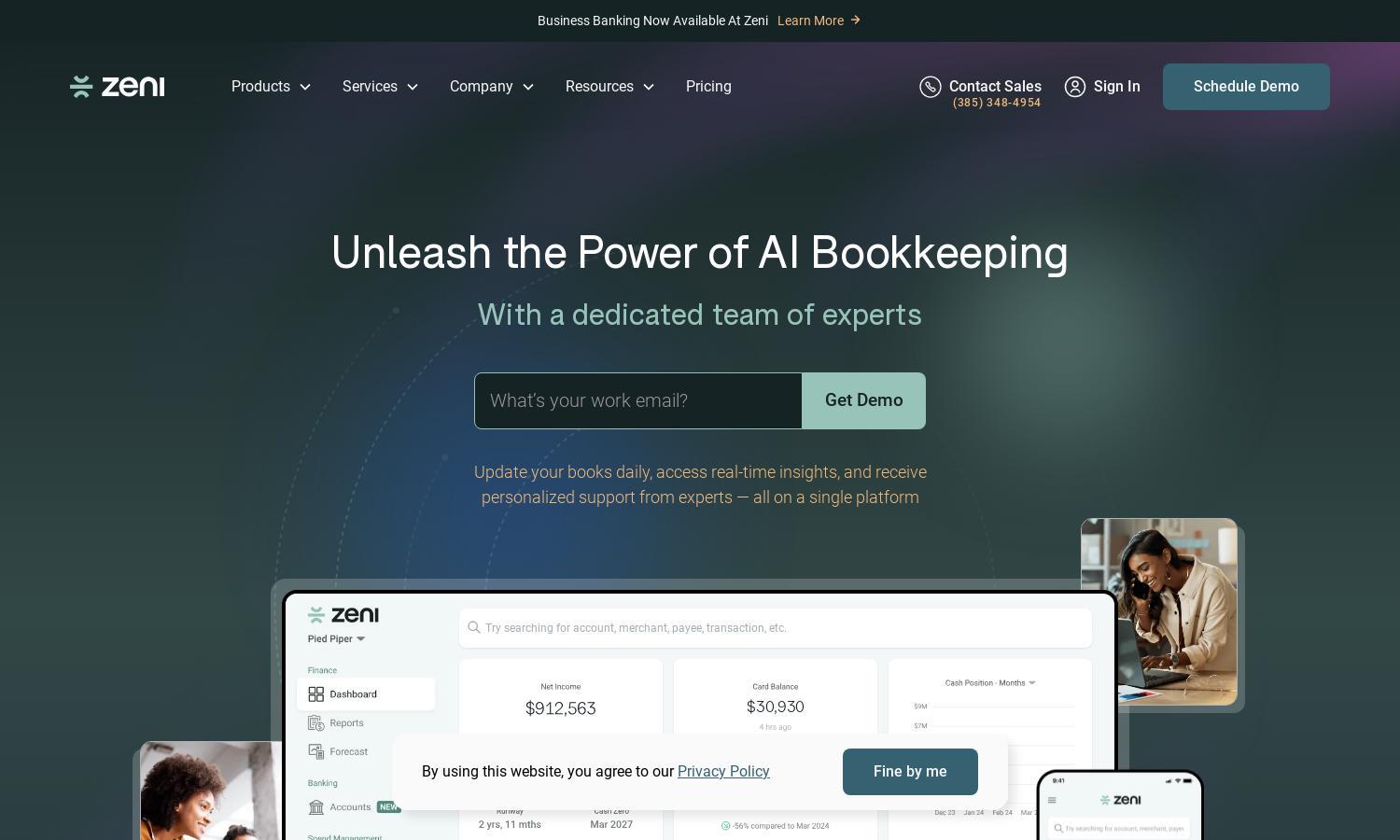

Zeni is a leading AI bookkeeping platform designed to streamline financial management for businesses of all sizes. With innovative features such as automated receipt processing and expert support, Zeni empowers users by providing real-time financial insights, enhancing decision-making, and freeing up valuable time for growth.

Zeni offers flexible pricing plans tailored to various business needs, ensuring affordability and value. Users can choose from basic to comprehensive packages that increase features as businesses scale. By upgrading, users gain access to specialized financial support, advanced automation, and personalized insights for enhanced growth.

Zeni's user interface is intuitively designed for seamless navigation, ensuring users can easily access and manage their financial data. The platform's clean layout enhances the user experience, with easily identifiable key features that make bookkeeping straightforward and efficient, helping users focus on their core business activities.

How Zeni works

To begin with Zeni, users sign up and onboard by inputting essential financial information and connecting their accounts. The platform's AI automatically categorizes transactions and processes receipts, offering real-time insights on a user-friendly dashboard. Users can then leverage personalized support from financial experts to enhance their bookkeeping strategies and ensure compliance.

Key Features for Zeni

AI-Driven Bookkeeping

Zeni’s AI-Driven Bookkeeping is a standout feature that automates the categorization of transactions and receipt processing. This unique capability simplifies financial management for businesses, allowing users to focus on strategic growth while ensuring accuracy and saving valuable time through efficient automation.

AI Bill Pay

Zeni’s AI Bill Pay feature streamlines payment processes, enabling users to automatically read and process invoices with ease. This adds significant value as it reduces administrative work and ensures timely vendor payments, enhancing cash flow management and operational efficiency for businesses.

Fractional CFO Services

Zeni’s Fractional CFO Services provide businesses with expert financial guidance without the need for a full-time hire. This key feature offers personalized insights and strategic planning support, helping users navigate complex financial decisions while focusing on growth areas, making it an invaluable resource for startups and established companies.

You may also like: