Teragonia

About Teragonia

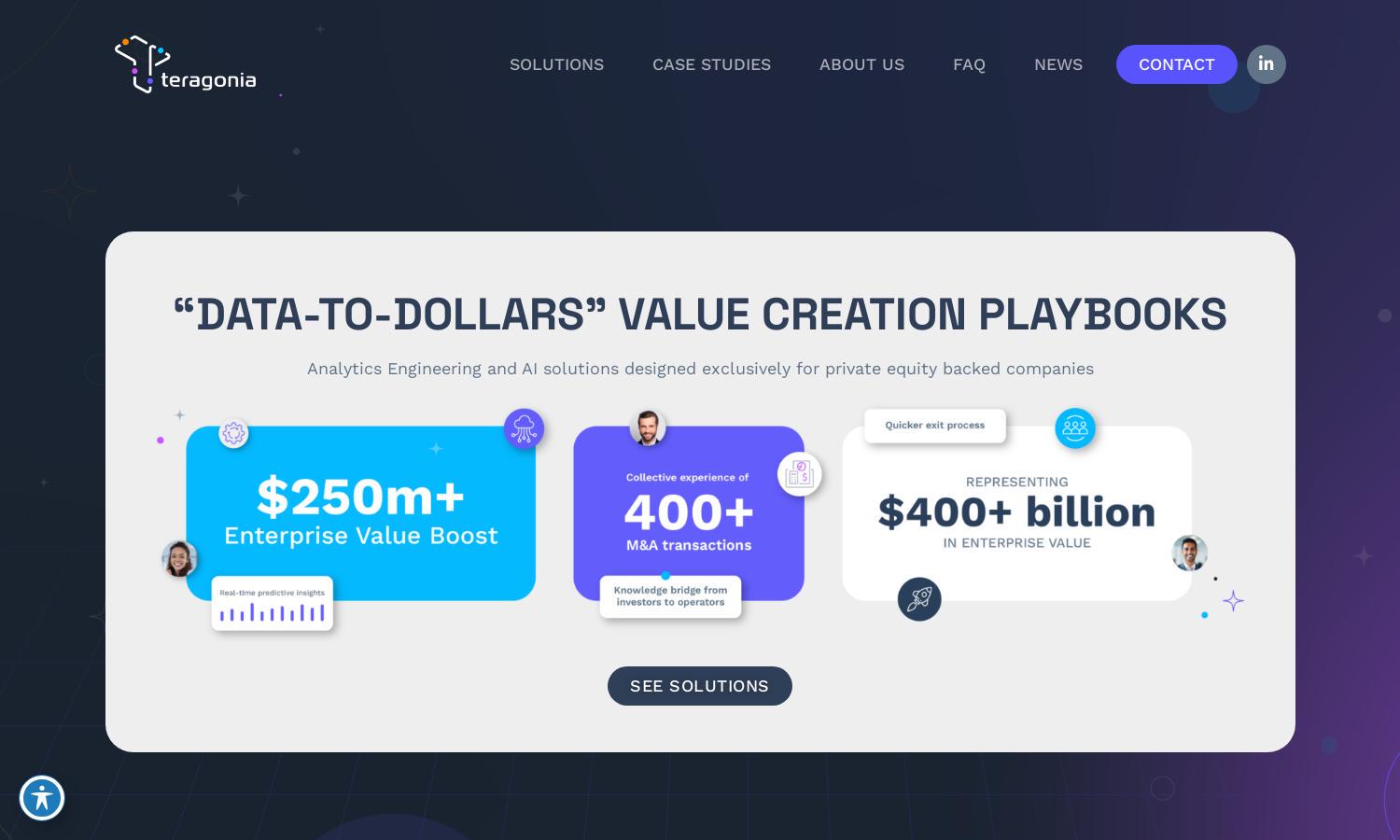

Teragonia is dedicated to enhancing private equity and founder-owned companies by providing innovative analytics engineering and AI solutions. With a focus on high-quality data management and real-time insights, Teragonia empowers businesses to optimize decision-making processes, drive EBITDA gains, and unlock hidden value in their portfolios.

Teragonia's pricing plans cater to diverse client needs, offering flexible subscription tiers that unlock varying levels of analytics and AI services. Upgrading enhances access to strategic insights, improved reporting, and dedicated support, enabling organizations to maximize their investment returns and achieve quicker exit processes.

Teragonia features a user-friendly design that simplifies navigation, ensuring a seamless browsing experience for users. The layout is optimized for quick access to essential tools and resources, allowing clients to leverage analytics for decision-making efficiently. This intuitive interface fosters engagement and enhances productivity.

How Teragonia works

Users interact with Teragonia by initially onboarding through a structured process that includes needs assessment and goal alignment. Once onboarded, clients navigate a comprehensive dashboard that showcases analytics tools, real-time reporting features, and AI-driven insights tailored to their business needs, facilitating enhanced decision-making and operational efficiencies.

Key Features for Teragonia

End-to-End Analytics Solutions

Teragonia offers end-to-end analytics solutions that empower private equity and founder-owned companies to transform data into actionable insights. This feature streamlines value creation, enhances reporting accuracy, and fosters data-driven decision-making, ultimately driving significant investment returns and achieving business objectives.

Real-Time Data Insights

Teragonia’s real-time data insights feature enables businesses to monitor key performance metrics live, making swift data-driven decisions feasible. This capability enhances operational responsiveness, supports strategic planning, and helps maximize proforma value capture during exit phases, establishing Teragonia as a competitive partner for portfolio growth.

Customized AI Solutions

Teragonia’s customized AI solutions uniquely support organizations in optimizing their data utilization. By tailoring AI functionalities to specific business needs, Teragonia enhances the potential for effective decision-making, ensuring clients capture value from their data investments effectively and efficiently.

You may also like: