TaxGPT

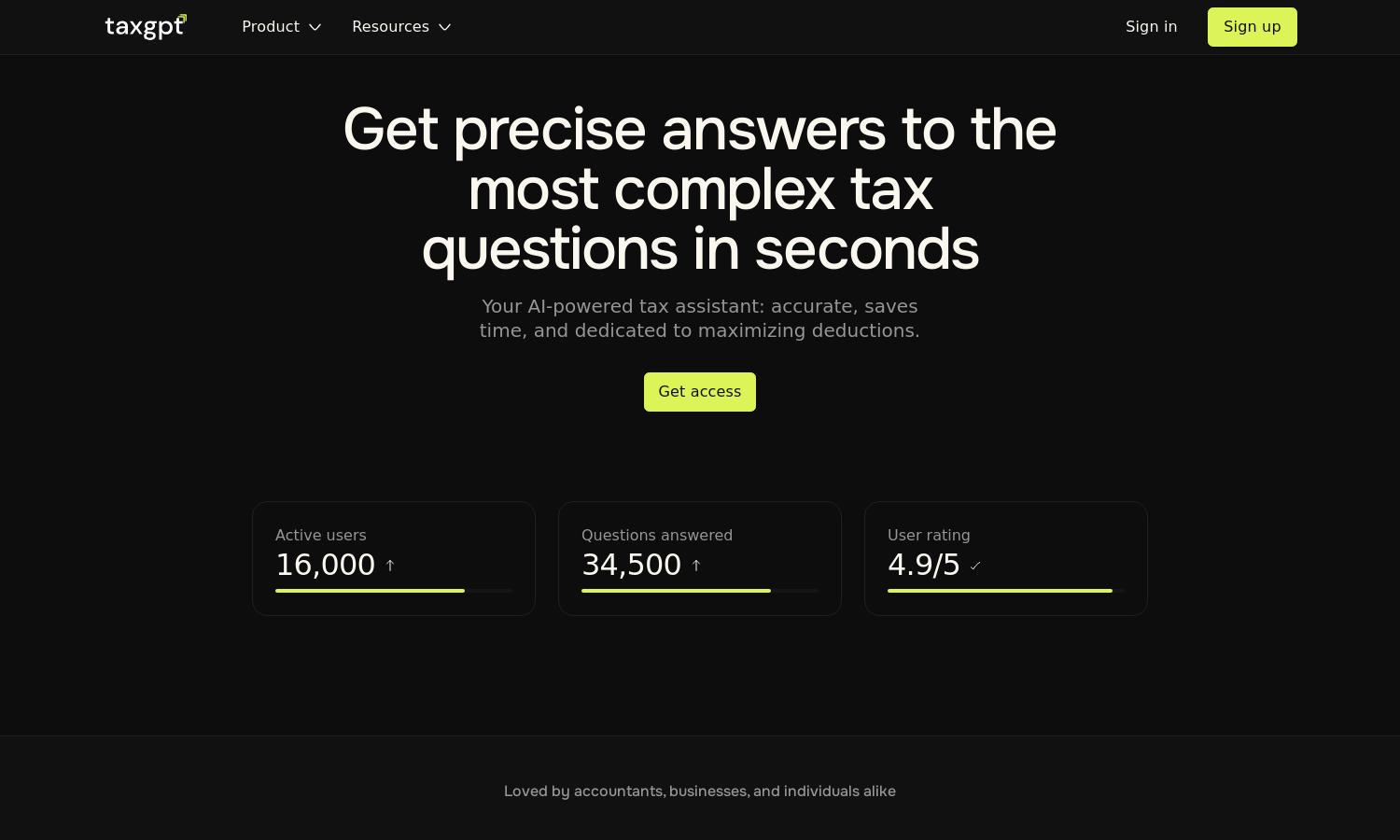

About TaxGPT

TaxGPT is a groundbreaking AI tax assistant that streamlines operations for accountants, tax professionals, and businesses. It offers a seamless experience to answer complex tax queries and manage documentation. With its advanced productivity tools, TaxGPT ensures a significant reduction in research time and accurate responses for all users.

TaxGPT offers a free 14-day trial for all users, allowing them to explore its features without commitment. Following the trial, users can choose from various subscription tiers depending on their needs, with special discounts for long-term subscriptions. Upgrading provides added efficiency and access to premium features.

TaxGPT features a user-friendly interface designed for easy navigation, creating an optimal user experience. Its layout allows users to access key functionalities with minimal clicks, making tax assistance straightforward. The design prioritizes usability, ensuring that all users can effectively engage with the platform's extensive resources.

How TaxGPT works

Users can easily interact with TaxGPT by signing up and onboarding through a simple registration process. Once registered, they can navigate the intuitive dashboard, where they can access various features, including tax queries, memo writing, and client management. TaxGPT harnesses advanced algorithms to provide real-time, accurate information tailored to user needs, greatly enhancing efficiency and effectiveness in tax management.

Key Features for TaxGPT

AI Tax Co-Pilot

TaxGPT's AI Tax Co-Pilot feature redefines efficiency for tax professionals, enabling them to tackle complex questions and streamline documentation processes. This core functionality distinctively enhances productivity, ultimately allowing users to save time and increase revenue, making it an invaluable tool for tax operations.

Secure Data Handling

TaxGPT prioritizes user data security through advanced encryption protocols and confidential handling of sensitive information. This key feature fosters trust among users, ensuring that their data remains protected while they benefit from the platform's powerful tax solutions, enhancing overall user confidence in their operations.

Maximized Deductions

TaxGPT excels in identifying eligible deductions, ensuring users don't overpay their taxes. This feature empowers accountants and tax professionals to optimize their clients' financial strategies, significantly increasing their value proposition and reinforcing TaxGPT's role as a vital resource in tax planning and compliance.

You may also like: