Skwad

About Skwad

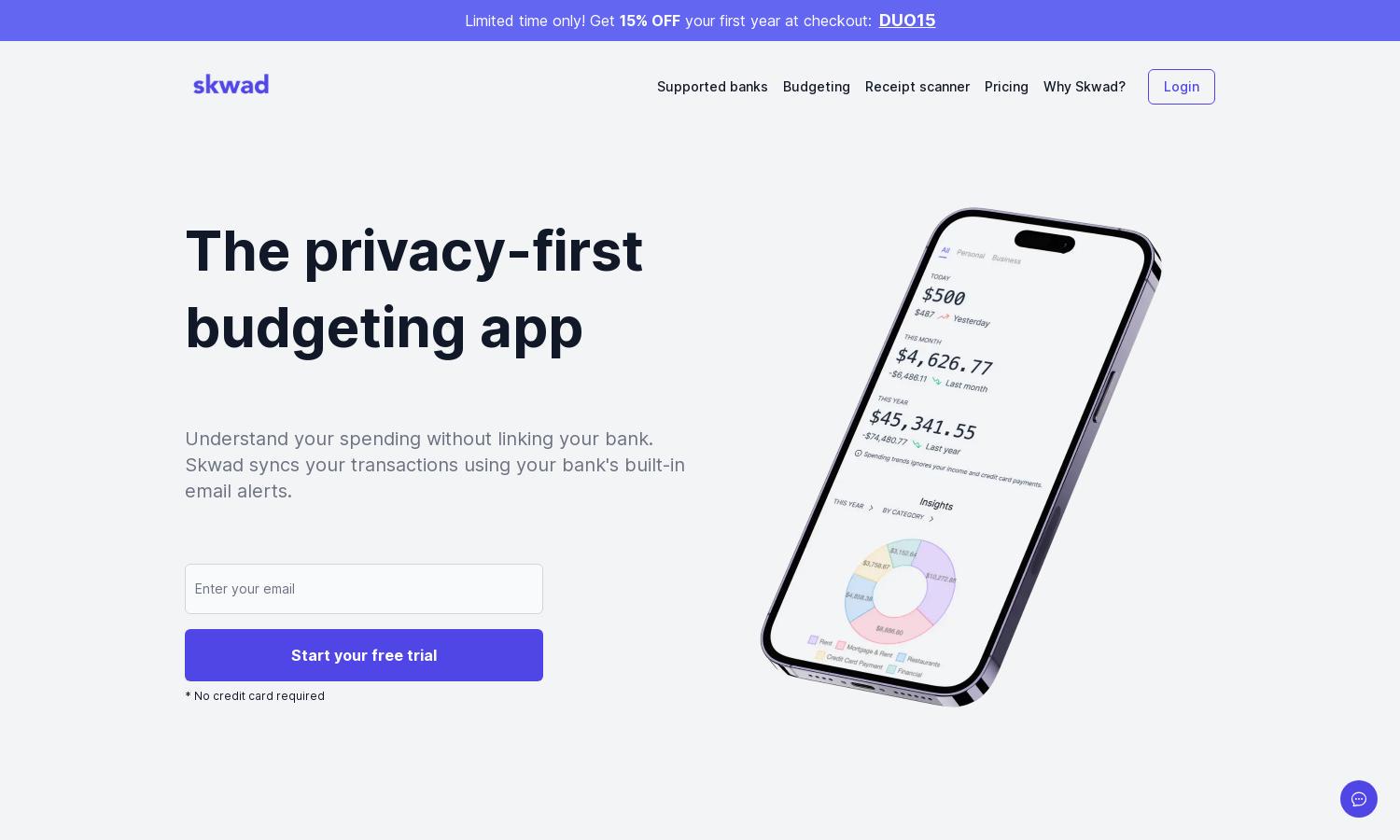

Skwad is an innovative budgeting app that maximizes user privacy while offering comprehensive financial insights. By leveraging bank email alerts for tracking, it simplifies expense management and categorization. Ideal for privacy-conscious users, Skwad transforms transaction alerts into organized financial data without storing sensitive banking credentials.

Skwad offers flexible pricing plans designed to suit varying user needs. Each subscription tier provides unique benefits, including transaction tracking and priority support. Users can take advantage of a 15% discount on their first year with the DUO15 code, ensuring affordable access to a feature-rich budgeting tool.

Skwad boasts a clean, user-friendly interface designed for effortless navigation. The layout allows users to quickly view transactions, categorize expenses, and generate reports. Enhanced features like customizable categories contribute to a seamless experience, empowering users to take control of their finances efficiently.

How Skwad works

Upon signing up for Skwad, users receive a dedicated email address to forward bank alerts. This simple yet powerful process enables instant synchronization of transactions without needing to link bank accounts. Users can categorize, track spending, and manage budgets easily, enhancing transparency and financial awareness—all while prioritizing security.

Key Features for Skwad

Instant Transaction Syncing

Skwad’s instant transaction syncing feature allows users to receive transaction updates immediately via email alerts. This unique functionality ensures real-time categorization and tracking of expenses, empowering users to maintain a clear view of their finances without the hassle of traditional bank links.

Customizable Expense Categories

Skwad offers fully customizable expense categories, enabling users to tailor their budgeting experience. This feature allows users to recategorize transactions, hide items, and break down expenses into detail, fostering a personalized approach to managing finances—all while simplifying tracking and understanding of spending habits.

Automated Transaction Importing

The automated transaction importing feature of Skwad lets users effortlessly pull in spending alerts and categorize them. This innovative aspect saves time and reduces manual entry, enhancing financial organization and ensuring users can monitor their budget accurately without compromising their banking security.