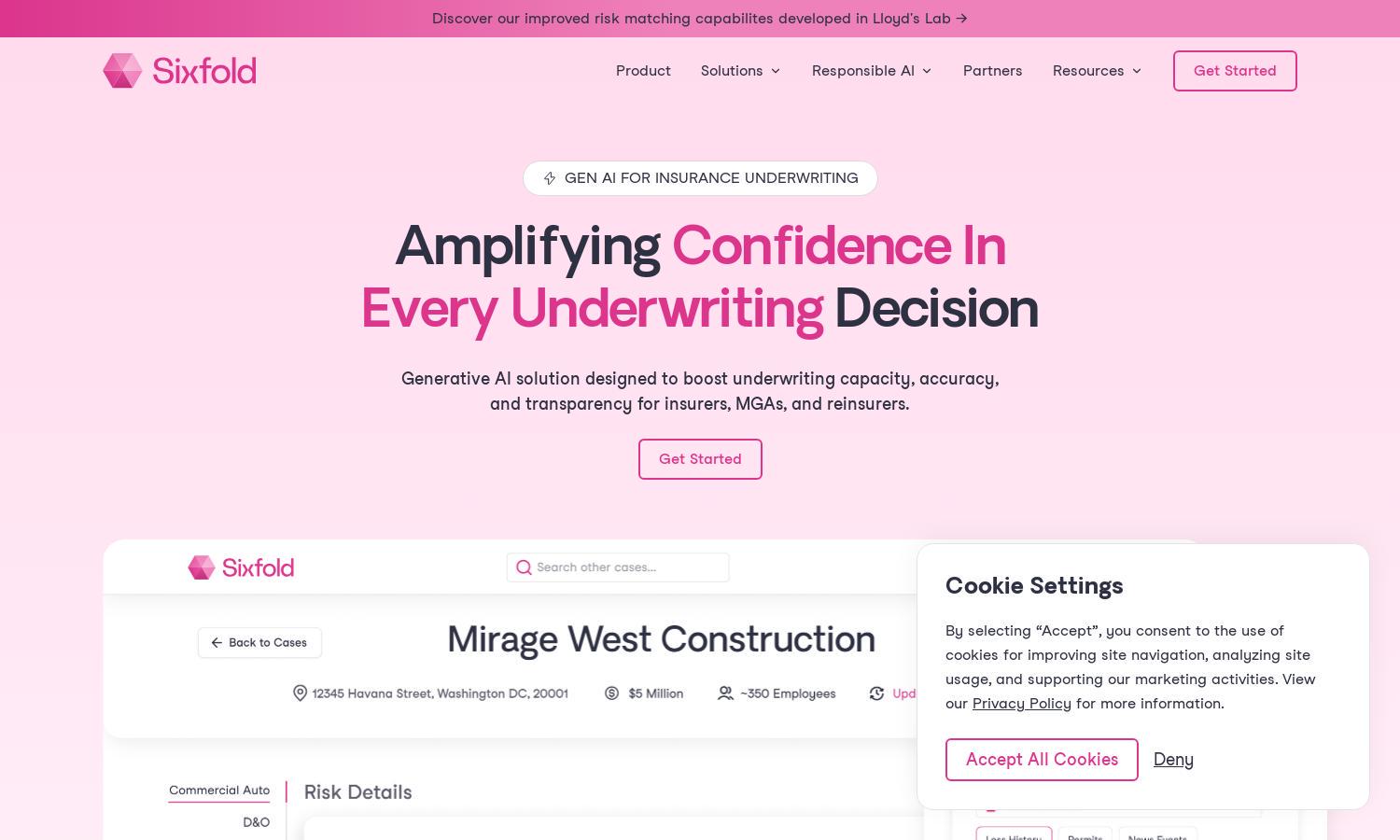

Sixfold

About Sixfold

Sixfold is an innovative platform designed for insurance underwriters, utilizing cutting-edge generative AI technology to optimize risk assessment processes. By ingesting underwriting guidelines and extracting vital data, Sixfold streamlines workflows, enhancing efficiency while ensuring full transparency in decision-making, ultimately empowering users to address complex challenges effectively.

Sixfold offers flexible pricing plans designed to cater to various underwriting needs. Each tier provides valuable features such as automated workflows, enhanced risk insights, and compliance tools. Upgrading unlocks advanced capabilities that further streamline processes, ensuring that users receive maximum efficiency and support tailored to their unique requirements.

The user interface of Sixfold is meticulously designed for seamless navigation and optimal user experience. Its clean layout, intuitive features, and easy-to-access tools allow underwriters to efficiently manage their tasks. Unique functionalities streamline data summarization, ensuring users can effectively utilize Sixfold while enhancing overall productivity.

How Sixfold works

Users begin by onboarding their underwriting guidelines into Sixfold, allowing the platform to ingest and process vital information. Once set up, they can easily navigate through its features, including risk data extraction from submissions and tailored recommendations for underwriting decisions. With built-in transparency and traceability, Sixfold enhances user confidence while ensuring compliance.

Key Features for Sixfold

Automated Risk Assessment

Sixfold's automated risk assessment feature revolutionizes how underwriters evaluate submissions. By employing generative AI, this function effectively analyzes data, identifies risk factors, and generates tailored insights. Users benefit from streamlined workflows, ensuring more efficient underwriting decisions, all while leveraging Sixfold's advanced capabilities to enhance their operations.

Transparency and Compliance

Transparency and compliance are cornerstones of Sixfold's approach. The platform ensures full traceability of underwriting decisions, providing users with complete visibility of data sources and processing paths. This commitment to transparency helps underwriters meet regulatory requirements while enhancing trust and confidence in their decision-making processes.

Customizable Solutions

Sixfold offers customizable solutions tailored to diverse insurance needs, encompassing various lines including P&C, Life, and Disability. By adapting to each underwriter's unique risk appetite, this feature allows users to optimize their workflows, empowering them to tackle specific challenges and enhance operational efficiency effectively.

You may also like: