Kniru

About Kniru

Kniru is an innovative AI-driven financial advisor designed for individuals seeking personalized financial guidance. With its cutting-edge chat interface, users effortlessly access insights on investments, retirement, and taxes, helping them make informed financial decisions. Kniru streamlines wealth management, ensuring user visibility and control over their finances.

Kniru offers tiered pricing plans to suit various user needs, ensuring value at every level. Subscribers can choose from basic to premium options, gaining access to advanced features and enhanced functionalities. Upgrading not only unlocks richer insights but also maximizes financial management benefits for users of the Kniru app.

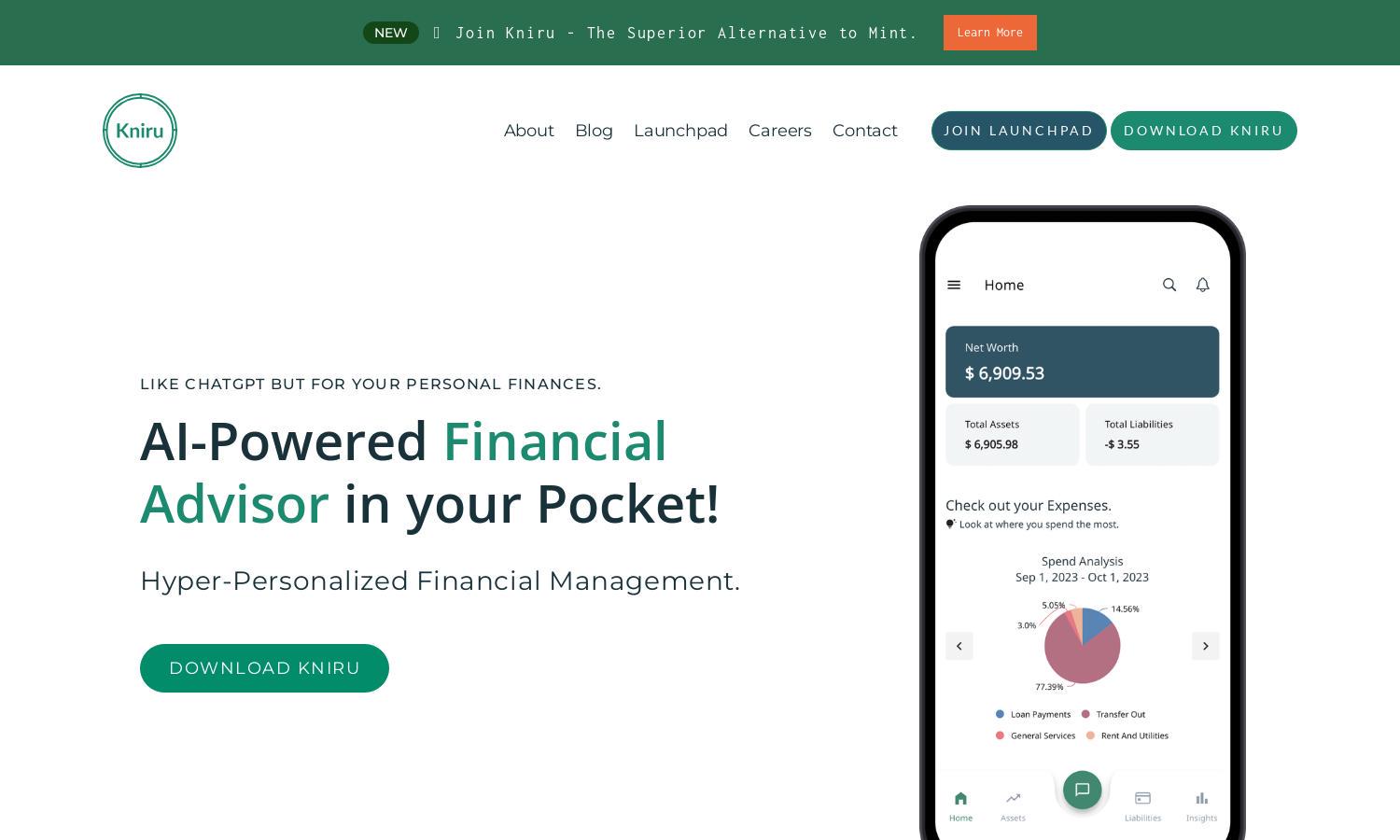

Kniru’s user interface features a clean and intuitive layout that enhances the overall browsing experience. Users can easily navigate through dashboards showcasing assets, liabilities, and insights, making financial management smooth and accessible. The design emphasizes functionality while ensuring that Kniru delivers a user-friendly experience.

How Kniru works

Users begin their journey with Kniru by signing up and linking their financial accounts, including banks and investment portfolios. Once onboarded, the AI analyzes their financial data and provides tailored insights through the chat interface. Kniru keeps users informed with alerts and suggestions, enabling them to manage expenses, retirement plans, and investment strategies with ease.

Key Features for Kniru

AI-Powered Financial Advisor

Kniru's AI-powered financial advisor feature offers personalized guidance to help users manage their finances effectively. By analyzing individual financial situations, Kniru provides tailored advice, ensuring users receive actionable insights that empower them to make informed financial decisions at any stage of their journey.

Hyper-Personalized Financial Management

Kniru specializes in hyper-personalized financial management, adapting to user preferences and unique financial contexts. This feature ensures that every analysis and recommendation is relevant, allowing users to navigate their financial journeys more effectively while maximizing their potential for wealth sustainability and growth.

Automated Alerts and Notifications

Kniru’s automated alerts and notifications keep users updated on their financial activities. Users receive timely reminders for bill payments, budget alerts, and portfolio changes. This proactive approach empowers users to stay on top of their finances and avoid unexpected expenses.