Kintsugi

About Kintsugi

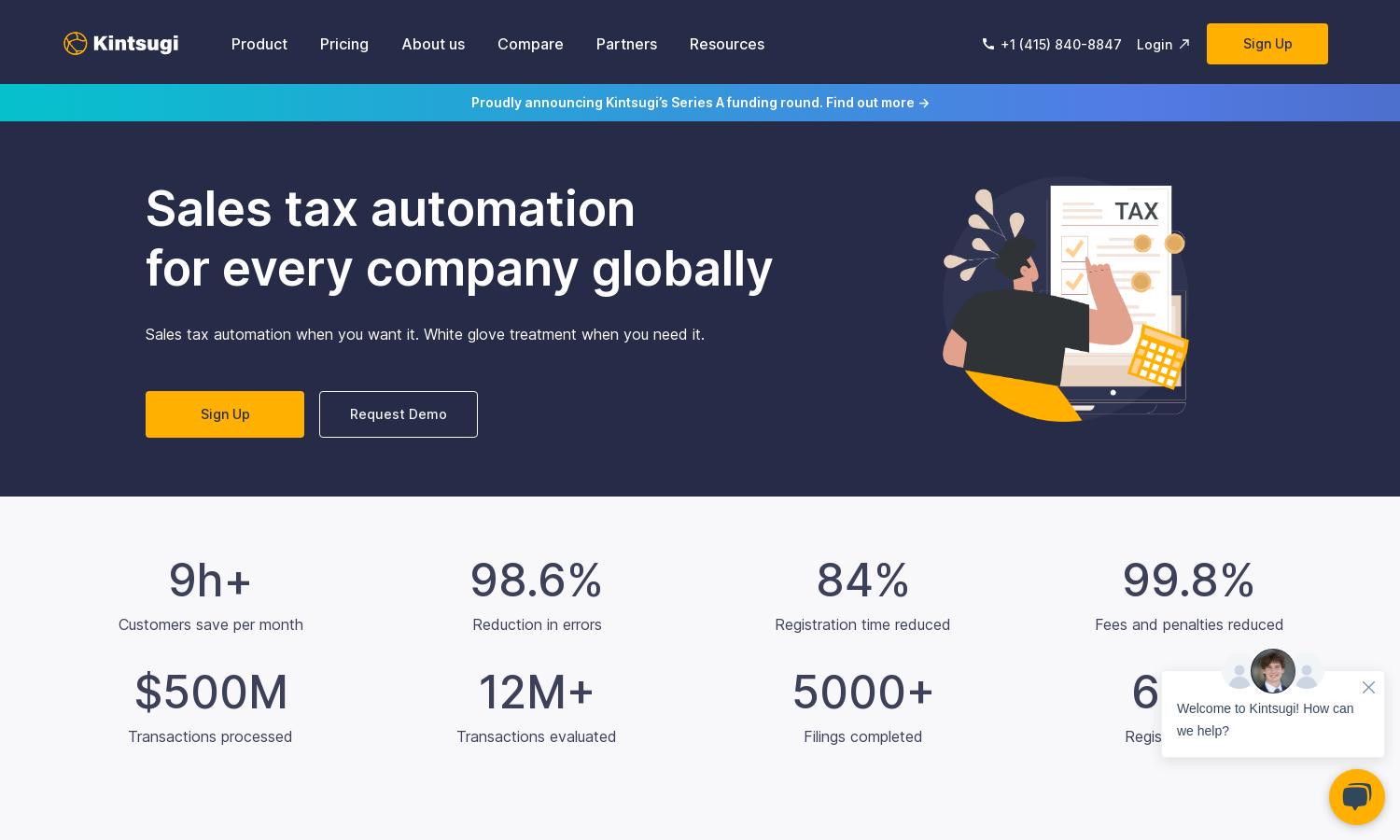

Kintsugi is a leading platform dedicated to automating sales tax compliance for businesses globally. It offers users a streamlined approach to manage their sales tax needs through precise calculations, easy integrations with billing and payment systems, and an intelligent insight into tax exposure, making it ideal for businesses of all sizes.

Kintsugi offers flexible pricing plans designed to suit various business needs. Starting with a free plan to get you started, it moves to competitive monthly fees, covering only when filings or registrations are required. Users benefit from a pay-as-you-go approach, ensuring no long-term commitment.

Kintsugi features a user-friendly interface designed for smooth navigation and efficiency. Users can easily access various functionalities from automated tax calculations to filing processes, all organized intuitively within the platform. This design enhances the user experience, allowing businesses to focus more on operations than on complicated tax matters.

How Kintsugi works

Users start by signing up for Kintsugi, where they receive a comprehensive audit to identify their nexus. The onboarding process is straightforward, allowing them to connect their existing billing, payment, and HR systems. Kintsugi then automates the registration for collecting the correct tax rates and ensures timely filing and remittance, simplifying the process significantly.

Key Features for Kintsugi

Automated Sales Tax Calculations

Kintsugi's Automated Sales Tax Calculations feature ensures businesses collect and remit sales tax accurately, minimizing errors and compliance risks. By leveraging intelligent technology, Kintsugi helps users stay updated on changing tax regulations, giving them confidence in their operations and saving time for strategic decision-making.

Seamless E-commerce Integration

Kintsugi's Seamless E-commerce Integration allows businesses to connect effortlessly with major platforms like Shopify and QuickBooks. This feature simplifies tax management, streamlining workflows and enhancing efficiency by automating data transfer between systems. Businesses can focus on growth while Kintsugi handles tax complexities seamlessly.

Comprehensive Tax Monitoring

Kintsugi offers Comprehensive Tax Monitoring to track tax exposure in real-time across multiple jurisdictions. This feature alerts users on potential nexus developments, ensuring they are always prepared for compliance. By facilitating proactive management, Kintsugi reduces the risk of unexpected tax liabilities for its users.

You may also like: