finbots.ai

About finbots.ai

finbots.ai is an AI-driven credit risk platform designed for lenders seeking improved decision-making processes. It allows users to build and implement custom scorecards rapidly, enhancing lending efficiency. By using powerful AI algorithms, finbots.ai boosts accuracy, fast-tracks approvals, and minimizes risks, empowering financial institutions to streamline operations.

finbots.ai offers competitive pricing plans for its CreditX platform, ensuring value for various lending institutions. Users can access affordable tiers tailored to their needs, with special discounts available for the first six months. Upgrading provides enhanced features for better risk management and improved lending decisions.

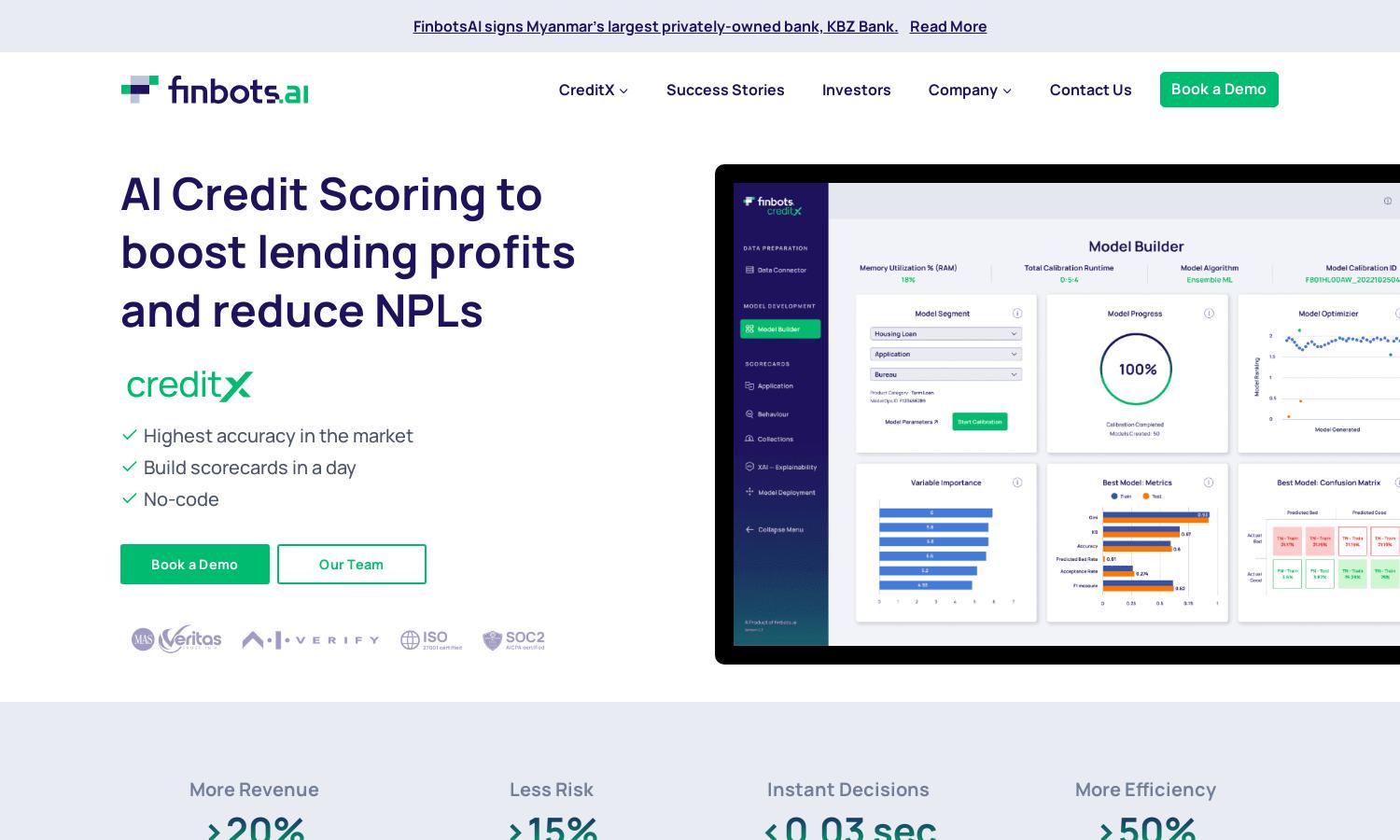

finbots.ai features a user-friendly interface designed for seamless navigation and ease of use. The layout allows users to build custom scorecards effortlessly, ensuring an intuitive experience. With unique functionalities like one-click deployment, users can quickly implement changes while enjoying the robust capabilities of finbots.ai.

How finbots.ai works

Users begin their journey with finbots.ai by onboarding their data onto the platform. Once set up, they can connect internal, external, and alternate data sources. The system’s AI automatically constructs and validates custom scorecards, allowing quick deployment and real-time decision-making. User-friendly features ensure an efficient lending process with reduced complications.

Key Features for finbots.ai

Rapid Custom Scorecard Creation

Finbots.ai allows users to quickly build custom scorecards using its proprietary AI technology, enhancing decision-making efficiency. With rapid deployment capabilities, lenders can create and implement credit models in as little as one day, significantly improving lending accuracy and reducing turnaround times.

Real-Time Decisioning

Finbots.ai's CreditX platform offers real-time decision-making capabilities, allowing lenders to process applications in under 0.03 seconds. This feature streamlines the approval process, enhancing customer satisfaction and increasing operational efficiency, solidifying finbots.ai as a leader in innovative lending solutions.

AI-Driven Predictive Analytics

Finbots.ai leverages advanced AI-driven predictive analytics to enhance credit scoring processes. By utilizing multi-layered data insights, the platform identifies non-linear patterns and optimizes decision-making, ensuring more accurate assessments and reduced risks for financial institutions and their clients.