Chart

About Chart

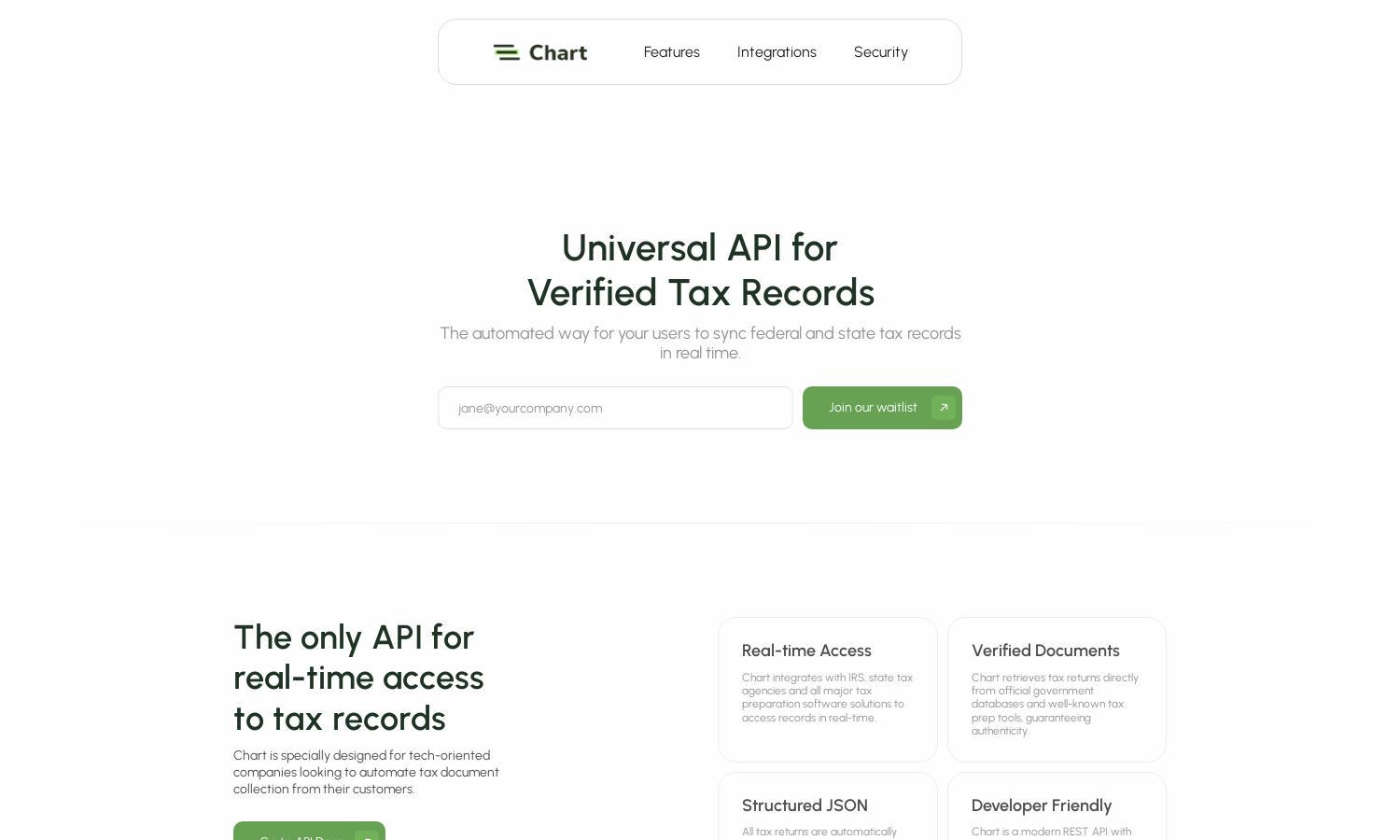

Chart is an advanced platform dedicated to automating tax document collection for tech companies. Through its universal API, users can swiftly access verified tax records from IRS and state agencies in real-time. This innovative approach ensures authenticity and security, ultimately streamlining user processes and enhancing productivity.

Chart offers flexible pricing plans designed to cater to various business needs. Users can benefit from different tiers that provide increasing access to features, including real-time API access and tailored support. Upgrading unlocks additional advantages, significantly enhancing the overall experience and capability of tax document automation.

Chart boasts a user-friendly interface designed for seamless navigation. Its intuitive layout guides users effortlessly through features such as tax record syncing and document access. The platform prioritizes an engaging experience, integrating helpful tools that enhance usability, making Chart the go-to solution for automated tax record management.

How Chart works

Users begin their journey with Chart by signing up and connecting their IRS or state tax accounts. The platform provides straightforward navigation to access features like real-time tax document syncing and submission options. By automating document collection and verification, Chart simplifies user interactions while ensuring compliance and security.

Key Features for Chart

Real-Time Access

Chart offers real-time access to tax records through its advanced API, ensuring instant connectivity. This dynamic feature stands out for its ability to seamlessly integrate with IRS and state agencies, empowering users to retrieve verified tax documents quickly, enhancing overall efficiency in tax management.

Verified Documents

The verified documents feature of Chart guarantees authenticity by retrieving tax returns directly from official databases. This unique aspect reassures users of document legitimacy, providing peace of mind while enhancing trust in automated tax processes—an essential benefit for tech-oriented businesses relying on accurate data.

Granular Access Control

Chart’s granular access control allows users to selectively choose which documents to share. This distinctive feature enables a personalized consent flow, enhancing privacy and ensuring that sensitive information is shared only when necessary, thereby empowering users to manage their data effectively while using Chart.